When National Social Security Fund (NSSF) released its 2023/24 financial statements, the Auditor General’s office was already sifting through a baffling bond transaction. Nancy Gathungu, Kenya’s Auditor General, flagged that the fund bought Treasury bonds worth Sh5.1 billion at face value and sold them for just Sh4.3 billion, sinking nearly Sh789 million of contributors’ retirement savings. The loss sparked a parliamentary probe, putting the fund’s investment governance under a microscope.

Background: NSSF’s investment mandate

The National Social Security Fund operates under the 2020 Investment Policy Statement, which mandates “prudent” investments that maximise returns for contributors. In theory, the fund should diversify across government securities, equities, and fixed‑income instruments while keeping risk in check.

However, the audit uncovered that six external fund managers were given “full discretion” over bond purchases, a practice that runs counter to the policy’s emphasis on oversight. The managers, whose identities were not disclosed, allegedly executed trades without a clear risk‑return analysis.

The treasury bond deal gone wrong

According to the Auditor General’s report, the problematic trades occurred between May and July 2024. NSSF bought Treasury bonds for a total nominal value of Sh5.2 billion but off‑loaded them for Sh4.32 billion, creating a shortfall of Sh789.2 million. The loss burrowed deeper because the bonds were purchased at a premium of Sh500.7 million above market rates, a detail that the fund has yet to explain.

- Purchase price: Sh5.2 billion (nominal)

- Sale price: Sh4.32 billion

- Net loss: Sh789.2 million

- Premium paid above market: Sh500.7 million

- Policy breached: 2020 Investment Policy Statement

Even more striking, the fund’s own records showed a mismatch between the bank statements and the internal ledger, suggesting that the loss was not merely a market fluctuation but a product of poor timing and inadequate supervision.

Parliamentary hearing and key testimonies

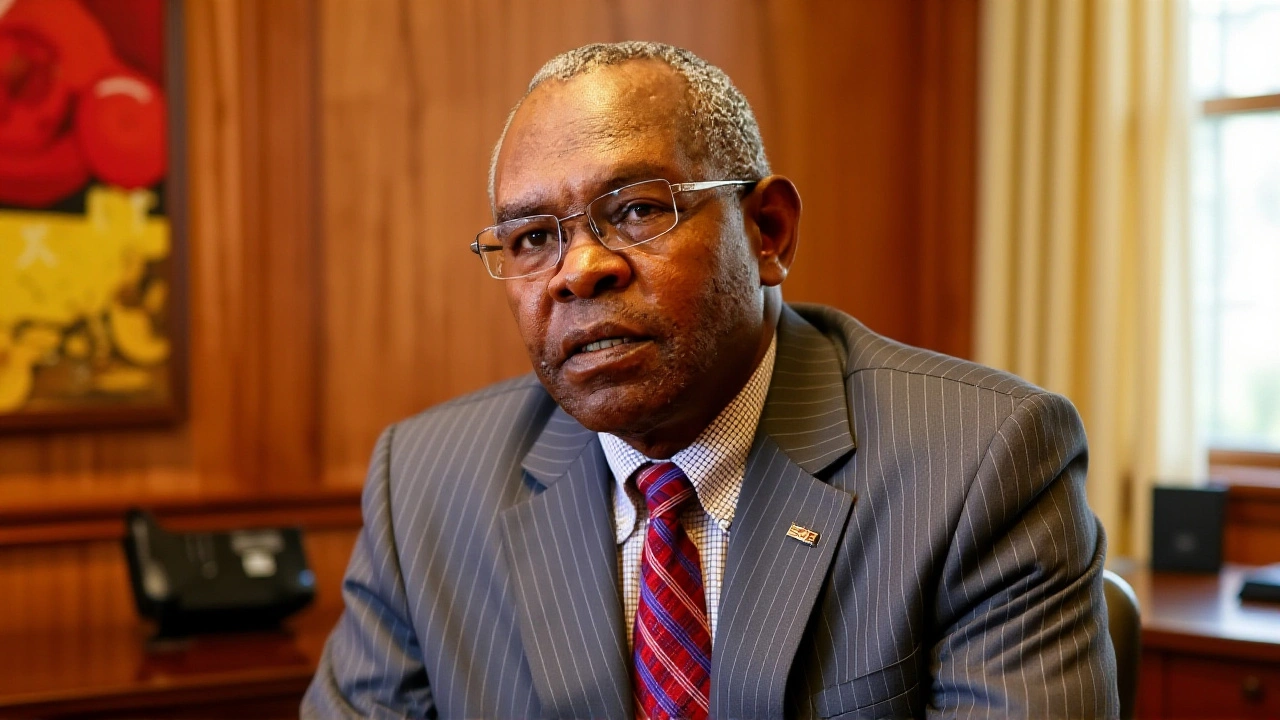

On 15 August 2024, the Public Investments Committee on Social Services, Administration and Agriculture (PIC‑SSAA) summoned NSSF CEO David Koross to answer for the bond debacle. The hearing, chaired by Caleb Amisi, the Saboti MP, turned into a tense exchange.

"We're talking about Sh12 billion in bond transactions," Amisi warned. "Was this really the most efficient way to invest public funds?" Koross struggled to provide a concrete rationale, merely pointing to the six external managers as the decision‑makers.

Amisi pressed further, asking why the fund did not hedge against price volatility or why it ignored the policy’s capital‑loss safeguards. Koross admitted that the fund’s internal risk team had raised flags, but those concerns were allegedly overruled by the managers seeking higher yields.

Broader financial irregularities uncovered

The bond loss was just the tip of the iceberg. The Auditor General’s report also highlighted:

- Tax refunds worth Sh940.3 million written off due to delayed reconciliation and missing paperwork.

- A desktop computer purchased for the reception area at a cost of Sh2.08 million — a price more than ten times the market rate for comparable units.

- An Upper Hill land parcel bought for Sh115 million that later had its title deed revoked in April 2010 because the land was earmarked for public use. Upper Hill is a prime commercial district in Nairobi.

- Investments in two private companies that saw their valuations drop by 17.64%, wiping out Sh27.2 million of members’ capital.

- Shares in a loss‑making bank valued at Sh38.4 million, with no clear evidence of value‑for‑money.

While NSSF’s net revenue surged 228.9% to Sh42.3 billion, operating costs also ticked up, and the expense‑to‑asset ratio slipped to 2.4%, still above the 2.0% ceiling set by the National Social Security Fund Act, 2013.

Implications for pensioners and future oversight

For the average Kenyan contributor, the bond loss translates into a modest reduction in future pension payouts, but the symbolic damage is far larger. Trust in the fund’s stewardship is eroding, and the parliament is now weighing the need for stricter legislative controls.

Experts suggest three immediate steps:

- Re‑centralise investment decision‑making within NSSF’s internal risk committee.

- Introduce real‑time audit trails for all large‑value transactions.

- Mandate independent external reviews of any investment that exceeds Sh1 billion.

If these reforms are adopted, they could restore confidence and safeguard the retirement savings of the nation’s workforce.

Frequently Asked Questions

How does the bond loss affect my future pension?

The Sh789 million shortfall will be spread across roughly 10 million contributors, shaving off only a few hundred shillings from each member’s eventual monthly payout. However, the loss signals weaker investment returns, which could compound over time if similar missteps recur.

Why were external fund managers given full discretion?

NSSF’s 2020 policy allowed outsourcing to specialist managers to achieve higher yields. In practice, the delegation was too broad, with six managers operating without a unified risk framework, a breach that the Auditor General highlighted.

What legal limits does the NSSF have on expenses?

Section 50 of the National Social Security Fund Act, 2013 caps total expenses at 2.0% of assets in the first six years and 1.5% thereafter. NSSF’s expense ratio of 2.4% in FY 2023/24 breached this threshold, exposing the fund to potential sanctions.

What steps are being taken to prevent future bond losses?

Parliament’s PIC‑SSAA is drafting amendments that would require any bond purchase above Sh1 billion to receive prior approval from an independent audit committee, alongside stricter reporting to the Auditor General.

Is the NSSF still financially healthy despite the losses?

On paper, the fund’s net revenue grew to Sh42.3 billion, but the rising expense ratio and the erosion of reserves from the bond and other mis‑investments raise concerns about long‑term sustainability unless governance reforms are enacted.

18 Comments

Jauregui Genoveva

October 7 2025

It’s infuriating to see a pension fund treat people’s retirement like a casino, especially when the government claims it champions the poor. 🙄 The loss isn’t just numbers; it’s trust being ripped apart.

Quinten Squires

October 8 2025

The audit shows a clear breach of fiduciary duty the managers acted without oversight the loss could have been avoided with proper risk models the policy was ignored and the contributors suffer.

Tyler Manning

October 9 2025

While the NSSF claims to safeguard Kenyan workers, this debacle reflects a dereliction of national duty. The fund’s stewardship must align with the sovereignty of our people, not betray it for speculative gain. Such negligence affronts the very essence of patriotic responsibility.

james patel

October 10 2025

From an asset‑liability management perspective, delegating full discretion to external managers without a robust governance framework contravenes standard fiduciary principles. The deviation from the 2020 Investment Policy Statement undermines the fund’s risk‑adjusted return objectives. Stakeholders demand transparent oversight mechanisms.

Scarlett Mirage

October 11 2025

One might argue that every financial institution faces market volatility, but when a fund pays a premium of Sh500.7 million above market, it borders on fiscal hubris! The moral calculus here is simple: accountability must outweigh ambition, lest we erode public confidence; indeed, the auditors have spoken.

Ian Sepp

October 12 2025

In light of these findings, it is imperative that NSSF revises its investment charter to incorporate stringent oversight protocols and periodic compliance audits. Such measures will ensure alignment with statutory expense caps and restore stakeholder trust.

Lois Parker

October 13 2025

This thing is a mess. They spent way too much on a computer and that land thing sounds shady. It’s just a big waste.

Lerato Mamaila

October 14 2025

From a South African perspective, transparency is key; the public deserves clear insight into how their contributions are managed! Let us hope reforms are swift and inclusive.

Dennis Lohmann

October 15 2025

We can all learn from this by emphasizing stronger internal controls and continuous mentorship for fund managers. 😊 Together, we can build a more resilient system.

Jensen Santillan

October 16 2025

The NSSF’s operational inefficiencies epitomize a systemic lack of strategic foresight; their asset allocation model appears to have been constructed on wishful thinking rather than empirical evidence. Moreover, the absence of a comprehensive hedging strategy indicates a profound underestimation of market dynamics. By delegating discretion without accountability, they have effectively outsourced risk without oversight-an anathema to sound financial governance. This scenario underscores the necessity for an independent audit committee, not merely as a procedural formality but as a critical safeguard against such fiscal imprudence.

Mike Laidman

October 17 2025

While the report highlights several red flags the fund’s expense ratio exceeding the statutory ceiling is particularly concerning. Immediate corrective action is essential to align with the Act’s provisions.

Grace Melville

October 18 2025

The audit reveals a pattern of governance failures that cannot be dismissed as isolated incidents. The premium paid on the Treasury bonds suggests a fundamental mispricing that should have been caught by the risk committee. External fund managers were granted excessive autonomy, bypassing essential checks and balances. This lack of oversight directly contributed to the Sh789 million loss. Furthermore, the mismatch between bank statements and internal ledgers indicates possible internal control breakdowns. The misallocation of funds toward overpriced assets, such as the computer purchase, reflects poor procurement practices. The land acquisition scandal adds a layer of legal risk to the fund’s portfolio. Asset‑liability mismatches could exacerbate future liquidity pressures. The elevated expense‑to‑asset ratio breaches statutory limits, raising concerns about fiscal discipline. Stakeholders demand transparent reporting and accountability from the fund’s leadership. Implementing real‑time audit trails would provide immediate visibility into high‑value transactions. Centralizing investment decisions within an internal risk committee would reduce reliance on external discretion. Independent external reviews for large investments would add an additional safeguard. Legislative reforms must codify these governance enhancements. Restoring public trust requires decisive action and clear communication. Continuous monitoring and periodic audits will ensure ongoing compliance. Ultimately, protecting contributors’ retirement savings is paramount and must guide all future fund activities.

Ashlynn Barbery

October 19 2025

These recommendations, if adopted, will substantially bolster fiduciary responsibility and enhance the fund’s operational resilience. The systematic integration of internal controls, coupled with external oversight, offers a comprehensive framework for sustainable governance.

Sarah Graham

October 19 2025

I echo the need for transparent processes and collaborative oversight, ensuring that all contributors feel secure about their future benefits.

J T

October 20 2025

Wow, that’s a lot of paperwork. 🤦♂️

A Lina

October 21 2025

The procedural deficiencies exposed herein demand immediate remediation; adherence to statutory guidelines is non‑negotiable for fiduciary integrity.

Virginia Balseiro

October 22 2025

Let’s turn this crisis into a catalyst for change! With bold reforms, NSSF can emerge stronger, more transparent, and truly worthy of the nation’s trust.

Jared Mulconry

October 23 2025

Hopeful that upcoming policy updates will prioritize accountability and protect contributors’ interests.