Unraveling Financial Mysteries: The $400,000 Question

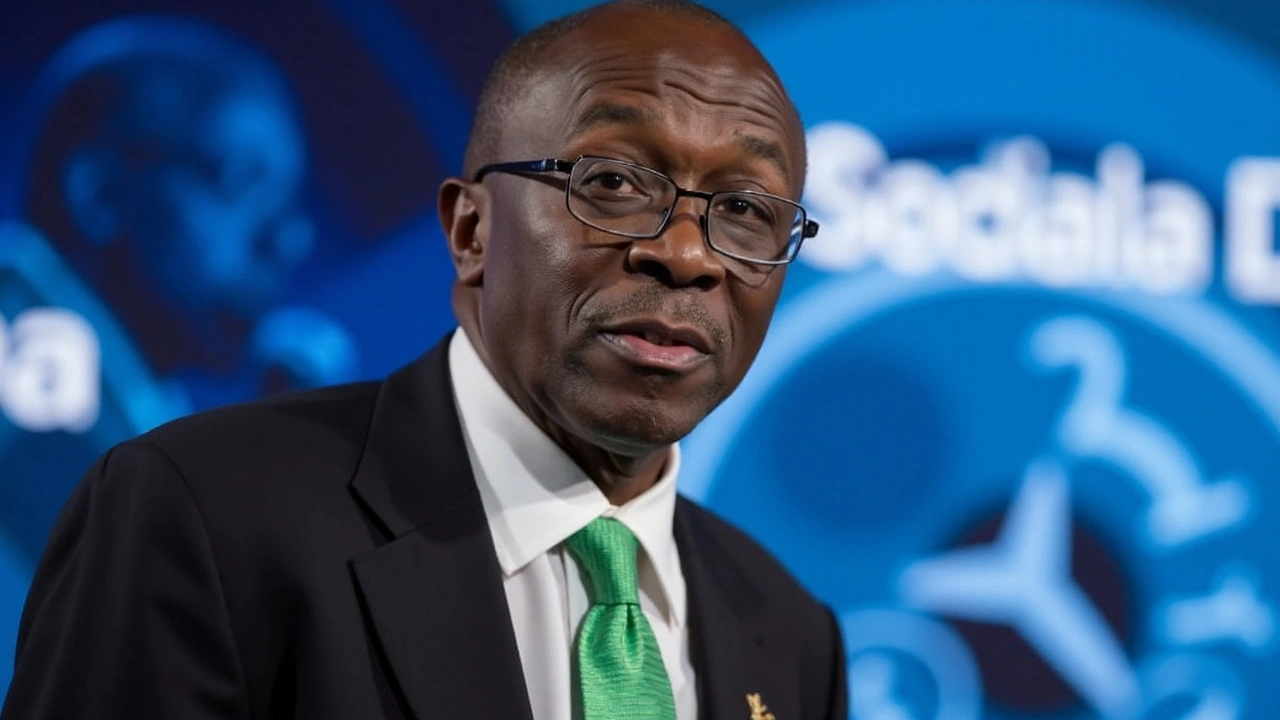

In the corridors of power, finances often swirl around like unseen currents beneath the surface of serene waters. Recent developments in a Lagos Special Offences Court have brought to light a tantalizing glimpse of this undercurrent with the testimony of John Adetola. Adetola, who formerly served as the Executive Assistant to Godwin Emefiele, the ex-Governor of the Central Bank of Nigeria (CBN), is at the heart of a legal battle that has gripped public attention and raised critical questions about financial integrity at the highest levels.

John Adetola’s testimony provides a window into a world where powerful figures orchestrate financial exchanges with the precision of a maestro leading an orchestra. According to Adetola, in 2018, he was tasked with an intriguing assignment: to collect $400,000 on behalf of Godwin Emefiele. This task did not appear out of thin air. It was initiated by Eric Odoh, Emefiele’s personal assistant, who provided Adetola with instructions to retrieve the money from John Ayoh, herself a notable figure as the former Director of the ICT department.

The Path of the Money

Adetola’s account of the transaction reads like a page from a detective novel. He narrates how he traveled to Lekki, Lagos—an area known for both its opulence and its secrecy—to reach Ayoh’s residence. There, amidst the backdrop of luxury and discretion, he was handed an inconspicuous envelope. Within its paper confines lay the substantial sum of $400,000, presumably unnoticed by the watchful eyes of Lagos.

This clandestine operation did not end with Adetola’s pocketing of the cash, of course. The primary chapter of the tale concluded with him delivering the envelope to none other than Godwin Emefiele. The specifics of this handing over, though perhaps mundane in action, are steeped in an air of suspense given the ongoing allegations surrounding Emefiele.

Understanding the Legal Implications

The courtroom revelations concerning the collection of such a princely sum are significant not only in isolation but also due to the broader charges that frame the ongoing trial. The case against Emefiele is built on alleged misconduct involving both $4.5 billion and N2.8 billion, placing him amid financial dealings of a scale that might cause even seasoned financiers to raise an eyebrow.

At the helm of the prosecution is the Economic and Financial Crimes Commission (EFCC), Nigeria's premier anti-graft agency. Their aim? To uncover the truth behind the murky waters of alleged fraud and abuse of power by Emefiele, supported in the dock by his co-defendant, Henry Omoile. The gravity of the accusations underscores the profound stakes of the trial—not just for Emefiele but for the broader integrity of the Nigerian financial system.

The Role and Reactions of Key Figures

Amongst the robust legal confrontation, Adetola’s role as a key prosecution witness cannot be understated. The courtroom's tension was palpable as Adetola laid bare the specifics of his roles and connections with the vast sums in question. His narrative, however, is not confined to the contents of his verbal testimony.

Adetola conceded that his involvement with the funds extended beyond mere memoranda. In February 2023, he found himself in the crosshairs of the EFCC once more, this time to offer a sworn statement regarding his financial entanglements during his tenure. Crucially, his cell phone became a treasure trove for investigators, unveiling documents that would be printed and presented to the adjudicators. Despite expected resistance from Emefiele’s defense team, these documents were admitted on the grounds of identification—a procedural step that could sway the balance of understanding in such a complex case.

The Bigger Picture: Financial Integrity in Focus

This case exemplifies significant issues that ripple through not only Nigeria’s financial sectors but also across global financial practices. Questions abound regarding the adequacy of checks and balances in preventing such alleged misuse of power. How often do sizeable transactions, such as the one involving Adetola, occur beneath the radar of regulatory oversight? What mechanisms are in place to guard against abuse by individuals in positions of considerable authority?

Answers to these questions remain the focus of both the current legal proceedings and public discourse. The role of watchdog agencies, the efficacy of internal governance within the CBN, and the ethical standards upheld by its former governor are subject to scrutiny as the trial progresses.

Looking Forward: Trial Proceedings and Potential Outcomes

As proceedings advance with measured gravity, the path ahead is fraught with challenges for both prosecution and defense. As the cross-examination of Adetola is scheduled to extend into December, each party braces for further evidentiary presentations and strategic argumentation meant to sway the scales of justice.

This unfolding legal drama promises revelations that may redefine perceptions of financial transparency, not only regarding Godwin Emefiele and his co-defendant but also concerning the Central Bank of Nigeria itself. Through this process, stakeholders within and outside Nigeria keenly await the outcome, hopeful for a result that promotes a culture of accountability and strengthens the barriers against fiscal mismanagement. As the tale evolves, one thing is certain: the quest for truth marches on, buoyed by those unyielding in their pursuit of financial transparency and ethical governance.

9 Comments

sunil kumar

November 30 2024

This is deeply concerning. The fact that such a large sum was transferred in cash via personal assistant suggests systemic gaps in financial oversight. If this is standard procedure, then the CBN's internal controls are either nonexistent or willfully ignored. We need independent audits, not just courtroom theatrics.

Derek Pholms

December 2 2024

Ah yes, the classic Nigerian financial opera: a man in a suit hands an envelope to another man in a suit, and suddenly we're all supposed to believe it's just 'administrative logistics.' Next they'll say the $400K was for 'office decor.' At this point, the only thing more transparent than the CBN's balance sheet is the collective eye-roll of the Nigerian public.

musa dogan

December 2 2024

Let me be perfectly clear - this isn't corruption. This is ART. The way that envelope was delivered? Pure cinematic genius. The Lekki setting? A metaphor for the hidden opulence of power. The silence of the witnesses? A symphony of complicity. Godwin Emefiele didn't just handle money - he conducted a masterpiece. The EFCC? They're just the critics who didn't get the invite to the premiere.

Mark Dodak

December 3 2024

I think it's important to recognize that in any large institution, especially one as complex as the Central Bank, there are layers of administrative delegation that can appear suspicious without malicious intent. Adetola was likely following protocols he believed were legitimate - whether those protocols were ethical or legal is another question entirely. The real issue here is not one person, but a culture where ambiguity in financial flows becomes normalized over time.

Stephanie Reed

December 4 2024

I hope this trial leads to real reform. People need to see that accountability isn't just a buzzword - it's the foundation of trust. If even one person in a position of power can move $400K without documentation, then no one’s money is safe. I believe change is possible, even in systems that seem broken.

Brian Gallagher

December 4 2024

From a macroprudential governance standpoint, the operational irregularities described constitute a material breach of fiduciary duty under Section 14.3 of the CBN Act, as amended by the Financial Integrity Reform Act of 2017. The absence of a transaction reference number, coupled with non-digital transfer mechanisms, violates baseline KYC/AML compliance thresholds established by the Nigerian Financial Intelligence Unit. This is not anecdotal - it's systemic.

Elizabeth Alfonso Prieto

December 5 2024

This is why I can't trust ANYONE in power anymore. I'm so sick of these rich men playing games with our money. How DARE they think they can just hand over $400,000 like it's pocket change? I'm crying just thinking about it. Someone should go to jail. Like, right now. This is evil. And the fact that they're still walking around free? Unforgivable.

Harry Adams

December 6 2024

The real scandal isn't the $400K - it's that we're still talking about it. In London, a transaction of this scale would be flagged by automated compliance bots before the envelope was opened. The fact that this is even a story in 2024 speaks volumes about the institutional decay in Nigeria’s financial architecture. The EFCC should be embarrassed.

Kieran Scott

December 8 2024

Let’s not pretend this is about transparency. This is a political witch hunt dressed up as justice. Adetola’s testimony is a classic case of a subordinate trying to save his own skin by throwing his boss under the bus. The envelope? Probably filled with cash. But also probably filled with context we’ll never see because the media and the EFCC are too busy feeding the mob. The real crime here is the erosion of due process - and you’re all too busy clapping to notice.